SBCorp to offer small firms loans for typhoon recovery

THE Small Business Corp. (SBCorp) is offering a special loan facility to micro, small and medium enterprises (MSMEs) affected by Typhoon Carina, the Department of Trade and Industry (DTI) said.

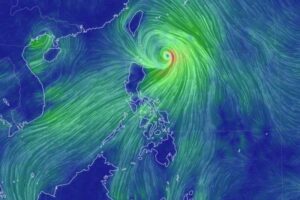

“We understand the challenges businesses face as they work to rebuild and resume normal operations after the devastating impact of this typhoon, which surpassed even the rainfall record of Super Typhoon Ondoy,” SBCorp President and Chief Executive Officer Robert C. Bastillo said.

“This emergency fund, offering concessional terms not currently available in the market, aims to finance the immediate needs of MSMEs. These needs include the repair and replacement of damaged fixed assets and inventory, operational disruption, and revenue losses,” he added.

Borrowers will be offered up to P300,000, payable monthly over up to three years with a three-month grace period.

The loan will be interest-free in the first year, and charge 1% interest on the balance in subsequent years.

According to SBCorp, MSMEs in the National Capital Region, Ilocos Norte, La Union, Bataan, Pampanga, Bulacan, Cavite, and Rizal are eligible to apply for the program.

Meanwhile, small businesses in some municipalities in Tarlac, Laguna, Oriental Mindoro, Romblon, Zamboanga, Davao Occidental, and Cotabato may also qualify.

“Existing borrowers who are (actively paying loans) and have yet to fully reach the P300,000 loan cap can quickly access this facility without needing to submit any documentary requirements,” Mr. Bastillo said.

“New borrowers only need to submit their Mayor’s Permit or Barangay Micro Business Enterprise (BMBE) Certificate for loans over P100,000, or Barangay Certification for loans of up to P100,000,” he added.

All new borrowers are also required to provide government-issued ID, proof of bank or e-money account, and corporate documents, if applicable. — Justine Irish D. Tabile